The Of Medicare Supplement Agent

Table of ContentsThe Facts About Medicare Part D RevealedMedicare Advantage Plans Can Be Fun For EveryoneEverything about Medicare Advantage PlansThe Greatest Guide To Medicare Part D

To put it simply, a chronically sick recipient would possibly benefit more by having the wider series of service providers used via Original Medicare and Medigap. Medicare Advantage plans are best fit for healthy and balanced recipients that don't make use of lots of wellness care solutions. With a Medicare Benefit plan, this kind of policyholder could come out in advance, paying little in the way of premiums as well as copays while taking benefit of rewards to remain healthy such as gym memberships, which are provided as part of some plans.

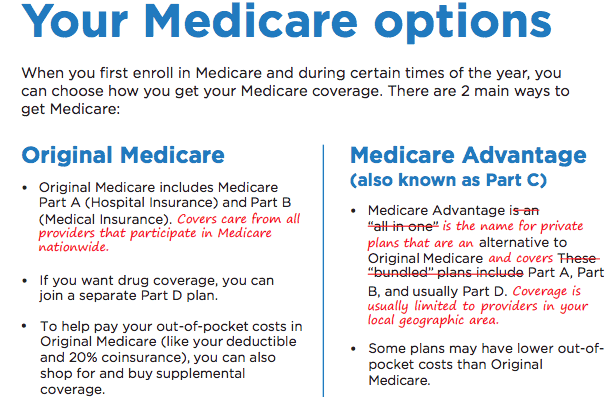

There are two main methods to obtain Medicare insurance coverage: Initial Medicare, A Medicare Benefit Strategy Original Medicare includes Part A (health center insurance) and Component B (clinical insurance policy). To help spend for things that aren't covered by Medicare, you can choose to purchase additional insurance coverage understood as Medigap (or Medicare Supplement Insurance Coverage).

, which covers all copays as well as deductibles. If you were eligible for Medicare prior to that time yet haven't yet enlisted, you still might be able to get Strategy F or Plan C.

More About Medicare Part D

If you don't acquire it when you first end up being qualified for itand are not covered by a drug strategy via work or a spouseyou will certainly be billed a lifetime charge if you shop it later. A Medicare Benefit Strategy is intended to be an all-in-one alternative to Original Medicare.

Medicare Benefit Strategies do have a yearly limit on your out-of-pocket expenses for clinical solutions, called the optimum out-of-pocket (MOOP). As soon as you reach this limit, you'll pay nothing for covered services. Each plan can have a various restriction, and also the limit can change every year, to ensure that's a variable to consider when purchasing one.

Out-of-pocket costs can promptly develop up throughout the years if you get unwell. The Medicare Advantage Strategy may offer a $0 costs, but the out-of-pocket shocks may not be worth those preliminary savings if you obtain ill. "The best prospect for Medicare Advantage is a person who's healthy," claims Mary Ashkar, senior lawyer for the Center for Medicare Advocacy.

Nevertheless, you might not be able to acquire a Medigap policy (if you change after the abovementioned 12-month limitation). If you have the ability to do so, it may set you back even more than it would have when you first enlisted in Medicare. Bear in mind that an employer just requires to provide Medigap insurance policy if you meet certain needs concerning underwriting (if this seeks the 12-month duration).

All about Best Medicare Agent Near Me

A lot of Medigap plans are issue-age rated policies or attained-age rated plans. This suggests that when you subscribe later in life, you will pay even more each month than if official site you had actually started with the Medigap policy at age 65. You might have the ability to discover a policy that has no age rating, yet those are uncommon.

Additionally, be sure to learn if all your medical professionals approve the plan and also that all the medicines you take (if it's a plan that additionally covers partially D prescription medicine protection) will be covered. If the strategy doesn't cover your existing doctors, be sure that its physicians are acceptable to you and also are taking new people covered by the plan (Medicare Supplement Agent).

Medicare is our country's medical insurance program for individuals age 65 or older. Certain individuals younger than age 65 can get approved for Medicare also, including those with handicaps and those that have irreversible kidney failure (Medicare Advantage Agent). The Discover More Here program aids with the cost of health and wellness treatment, but it does not cover all medical costs or the price of many long-lasting treatment.

Medicare Part A (healthcare facility insurance policy) helps pay for inpatient treatment in a hospital or restricted time at a skilled nursing facility (complying with a health center stay). useful content Part A likewise pays for some house healthcare and hospice care. Medicare Part B (medical insurance coverage) assists spend for solutions from medical professionals and also various other health care service providers, outpatient care, house health and wellness treatment, long lasting clinical devices, and also some preventative solutions.

Fascination About Best Medicare Agent Near Me

You can enroll in Medicare medical insurance (Part B) by paying a month-to-month costs. Some beneficiaries with greater earnings will pay a greater month-to-month Part B premium. To read more, review Medicare Premiums: Policies For Higher-Income Beneficiaries. With our on-line application, you can enroll in Medicare Part An and also Component B.

The following graph shows when your Medicare Component B comes to be efficient in 2022: In 2022, if you subscribe during this month of your IEP Your Component B Medicare protection begins One to three months prior to you reach age 65 The month you transform age 65. The month you reach age 65 One month after the month you transform age 65 - Best Medicare Agent near me.